European Demand Peaks and Aluminum Prices are Under Pressure

The original news comes from this link:https://alu.ccmn.cn/news/ZX003/202206/a1b727adc0954bebbc8d42a20b16352d.html

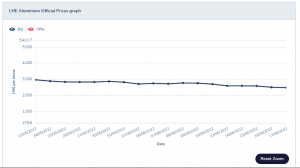

Aluminum futures market

The central banks of many countries have raised interest rates by the most in decades, and the foreign exchange market fluctuated greatly, pushing the US index higher and the metal under pressure. The following week saw little volatility in aluminum prices. The latest closing price was $2,503 per ton, closing down by $19 per ton, a decrease of 0.73%, the trading volume of 13,580 orders decreased by 9,507 orders, and the open interest of 573,677 orders increased by 4,871 orders. On the evening of June 17, Shanghai Aluminum opened higher and closed lower. The latest closing price of the July contract was $2930 per ton, down by $11.3 per ton, or 0.38%.

European and American Demand on Aluminum Decreased

According to the report of the European Automobile Association, passenger car registrations in May fell by 11.2% year-on-year to 791,546 units, the 11th consecutive month of decline, but the rate was narrowed compared to the 20% of the previous month. According to the date of association, in terms of sub-regions, Italy fell by 15.1%, Spain by 10.9%, Germany by 10.2%, and France by 10.1%. From January to May, the cumulative number of registrations of new passenger cars in the EU fell by 13.7% year-on-year. The data show that car demand in the EU is slowly picking up, but it is still too early to come out of the doldrums.

According to CRU’s weekly European and American premium report, the European and American aluminum ingot trade premiums have fallen for the third consecutive week, and the rate has increased. US Midwest P1020 fell to 32.5-33 cents/lb this week. The unpaid premium in Rotterdam remained unchanged at US$475-505/ton, while the duty-paid premium fell by US$15/ton to US$570-600/ton. German aluminum bar premiums fell $37.5/t to $1,400-$1,525/t. LME prices fell sharply, but the fear of demand recession intensified, and the trend of premium peaking was obvious. It is expected that the trend will be dominated by shocks and declines.

The LME inventory fell to 407,800 tons, the lowest level in the past 21 years. The main reason for the recent decline in inventory was the continuous departure of warehouse receipts. At present, the available inventory in the LME warehouse is only 171,000 tons, and the cancelled warehouse receipt is 236,000 tons. Pay close attention to the signal that the available inventory may have bottomed out.

The London Metal Exchange (LME) on June 17 reported the latest inventory of aluminum in London at 407,875 metric tons, a decrease of 3,700 metric tons or 0.90% from the previous trading day.

Under the high energy level, overseas demand fluctuated at a high level, but the liquidity contraction accelerated and recession expectations strengthened. From the perspective of fundamentals and cost, it is unlikely that a substantial adjustment will continue below $2930 per ton in the short term. Today’s $2930-$3000 per ton.

+86 159 6420 9667

+86 159 6420 9667  sales@haxrailing.com

sales@haxrailing.com